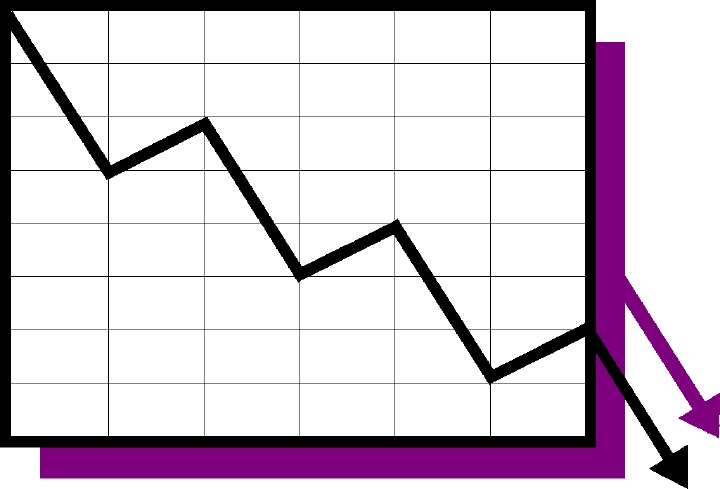

There's no quick fix to the global economy's excess capacity

There's no quick fix to the global economy's excess capacityAs a matter of strict fact, two- thirds of the global economy is already in “deflation-lite”.

US prices fell 2.1pc in July year-on-year, the steepest drop since 1950. Import prices are down 7.3pc, even after stripping out energy. At almost every stage over the last year, in almost every country (except Britain), deflationary forces have proved stronger than expected.

Elsewhere, the CPI figures are: Ireland (-5.9), Thailand (-4.4), Taiwan (-2.3), Japan (-1.8), China (-1.8), Belgium (-1.7), Spain (-1.4), Malaysia (-1.4), Switzerland (-1.2), France (-0.7), Germany (-0.6), Canada (-0.3).

Shipping Rates Seen Falling 50% on China, Fleet Size (Update1)

Shipping Rates Seen Falling 50% on China, Fleet Size (Update1)